All Categories

Featured

Table of Contents

That commonly makes them an extra economical option for life insurance coverage. Some term plans may not maintain the premium and fatality benefit the exact same gradually. You do not wish to erroneously believe you're acquiring degree term protection and after that have your survivor benefit modification later on. Many individuals get life insurance policy protection to aid economically secure their enjoyed ones in instance of their unanticipated fatality.

Or you might have the choice to convert your existing term coverage into a long-term plan that lasts the remainder of your life. Various life insurance policy plans have possible advantages and downsides, so it's important to comprehend each prior to you choose to acquire a policy.

As long as you pay the costs, your beneficiaries will receive the survivor benefit if you pass away while covered. That said, it is necessary to keep in mind that many policies are contestable for 2 years which implies insurance coverage could be rescinded on fatality, should a misstatement be found in the application. Policies that are not contestable typically have a graded death benefit.

Costs are usually less than entire life policies. With a degree term policy, you can pick your protection quantity and the policy size. You're not secured right into a contract for the remainder of your life. Throughout your plan, you never ever need to stress about the premium or survivor benefit quantities transforming.

And you can not squander your policy during its term, so you won't receive any type of economic gain from your past protection. Just like other kinds of life insurance policy, the expense of a level term policy relies on your age, coverage requirements, work, way of living and health and wellness. Commonly, you'll locate extra affordable coverage if you're younger, healthier and less dangerous to guarantee.

Preferred Group Term Life Insurance Tax

Since degree term costs stay the exact same for the duration of coverage, you'll know precisely how much you'll pay each time. That can be a huge assistance when budgeting your expenditures. Level term protection likewise has some versatility, allowing you to tailor your policy with additional attributes. These typically been available in the type of motorcyclists.

You might need to satisfy particular problems and qualifications for your insurance company to enact this cyclist. In addition, there might be a waiting period of approximately 6 months prior to working. There likewise might be an age or time frame on the insurance coverage. You can include a child rider to your life insurance coverage plan so it additionally covers your kids.

The fatality advantage is generally smaller, and protection usually lasts till your youngster turns 18 or 25. This cyclist may be a more cost-efficient method to help guarantee your youngsters are covered as bikers can usually cover numerous dependents simultaneously. Once your kid ages out of this coverage, it may be feasible to convert the cyclist right into a brand-new plan.

When contrasting term versus long-term life insurance policy. level term life insurance, it is very important to bear in mind there are a few different kinds. The most typical kind of irreversible life insurance policy is entire life insurance policy, but it has some vital distinctions compared to level term protection. Here's a basic summary of what to consider when comparing term vs.

Whole life insurance policy lasts permanently, while term insurance coverage lasts for a specific period. The premiums for term life insurance are typically lower than entire life coverage. Nevertheless, with both, the premiums stay the same for the period of the policy. Entire life insurance policy has a cash money value component, where a portion of the costs might expand tax-deferred for future demands.

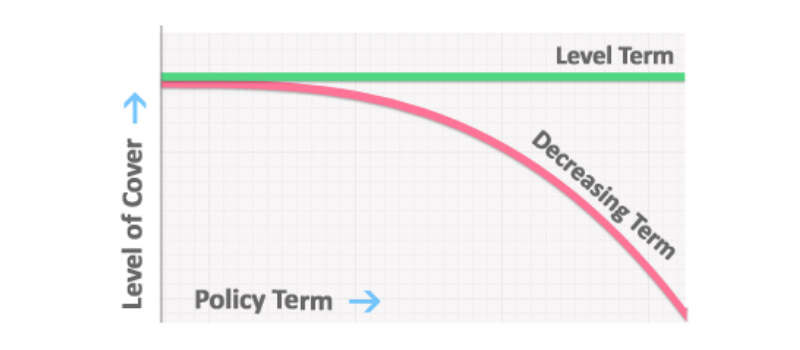

One of the major attributes of degree term insurance coverage is that your premiums and your fatality advantage do not change. You may have coverage that starts with a fatality benefit of $10,000, which can cover a home mortgage, and then each year, the fatality advantage will certainly lower by a set quantity or percentage.

Due to this, it's often an extra cost effective type of level term coverage., however it might not be enough life insurance coverage for your demands.

After making a decision on a policy, complete the application. If you're authorized, sign the paperwork and pay your very first premium.

Long-Term Annual Renewable Term Life Insurance

Consider organizing time each year to review your plan. You may wish to upgrade your recipient information if you've had any kind of considerable life adjustments, such as a marriage, birth or separation. Life insurance policy can occasionally really feel complex. But you do not have to go it alone. As you discover your choices, consider discussing your needs, desires and interests in a financial professional.

No, level term life insurance policy doesn't have cash value. Some life insurance policies have a financial investment attribute that permits you to build money worth gradually. A section of your costs repayments is set aside and can gain interest in time, which grows tax-deferred during the life of your coverage.

Nevertheless, these plans are often substantially extra expensive than term insurance coverage. If you get to completion of your policy and are still to life, the protection finishes. You have some choices if you still desire some life insurance policy protection. You can: If you're 65 and your insurance coverage has gone out, for example, you might intend to purchase a new 10-year level term life insurance policy plan.

Outstanding Term Life Insurance For Couples

You might have the ability to convert your term coverage right into a whole life policy that will last for the remainder of your life. Many kinds of level term policies are exchangeable. That indicates, at the end of your protection, you can transform some or all of your policy to whole life insurance coverage.

Degree term life insurance is a plan that lasts a set term generally between 10 and 30 years and comes with a degree fatality advantage and degree costs that stay the same for the whole time the policy is in result. This suggests you'll know precisely just how much your payments are and when you'll have to make them, allowing you to budget appropriately.

Degree term can be a wonderful choice if you're looking to buy life insurance policy protection for the very first time. According to LIMRA's 2023 Insurance Barometer Research, 30% of all adults in the U.S. demand life insurance policy and do not have any type of kind of policy. Level term life is foreseeable and budget-friendly, which makes it one of one of the most prominent kinds of life insurance policy.

Latest Posts

Average Cost Of Final Expense Insurance

Final Expense Agency

Funeral Plan Insurance